Depreciation recapture formula

So between 218180 the accumulated depreciation over twenty years and 368180 the realized gain the depreciation recapture will be applied to 218180. You saved 8640 in taxes 1728 times five.

1031 Exchange And Depreciation Recapture Explained A To Z Propertycashin

Straight Line Depreciation Method Cost of an Asset Residual ValueUseful life of an Asset.

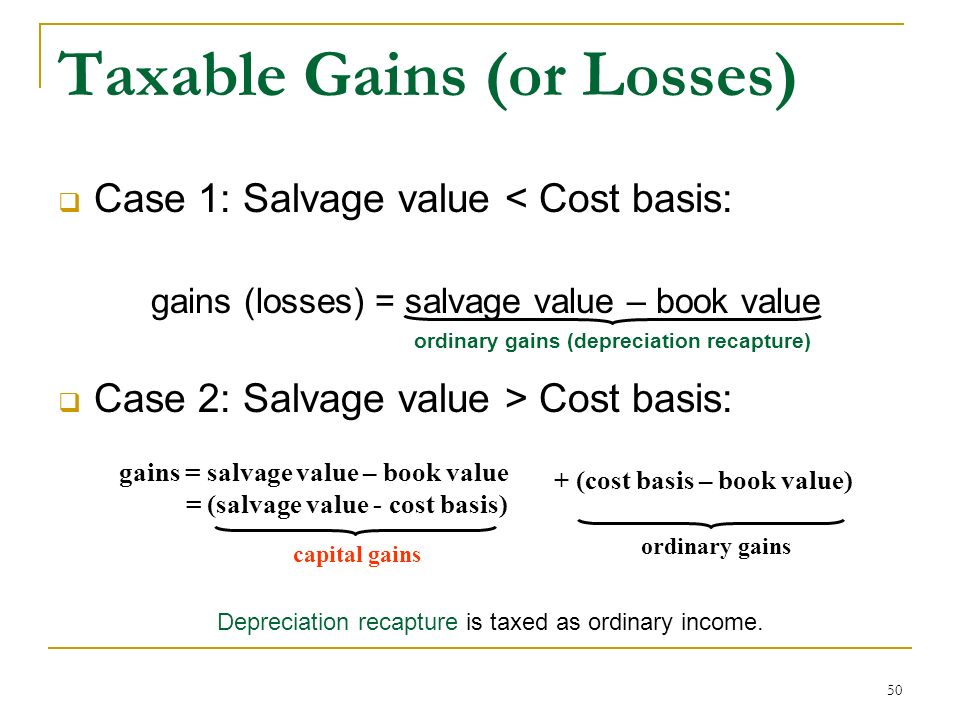

. Finally we will have to determine the nature of the gain capital gain vs. If those fees cost you 300 youd subtract that from the sale price. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

Remember the percentage of depreciation is represented mathematically two places from the decimal point when calculating. The tax rate will be tied to. Heres the formula used to determine basis and depreciation on commercial assets.

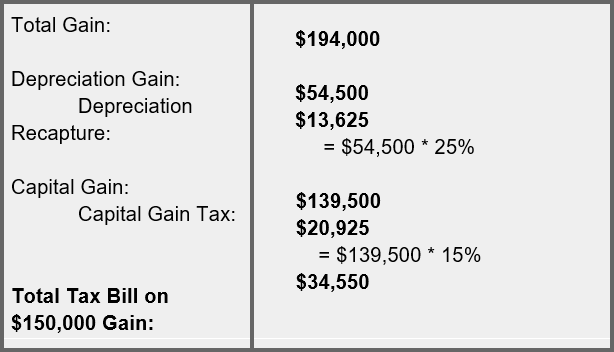

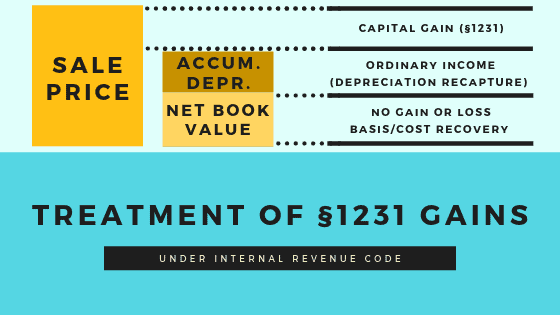

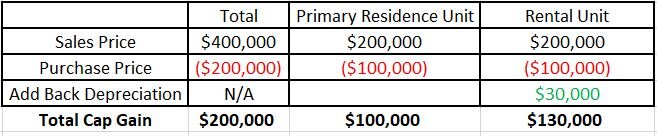

The realized gain is taxed as ordinary income. Diminishing Balance Method Cost of an Asset Rate. For example the first-year.

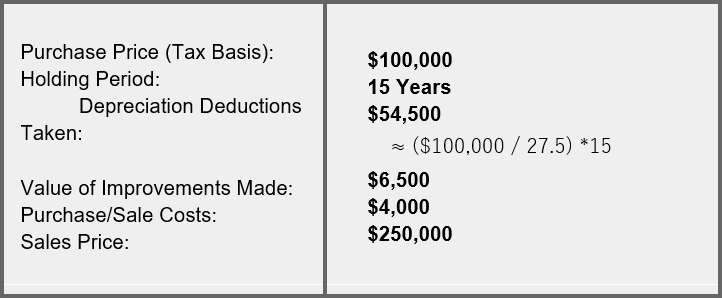

Cost of your property minus the value of the landBasis. If the capital gains rate is 15. Second we will need to calculate the gain using the following formula.

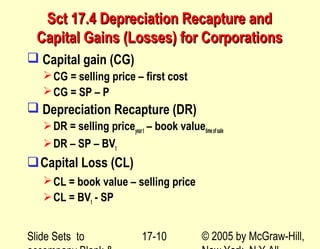

In this situation the UCC is also 6000 10000 - 4000. It uses a fixed rate to calculate the depreciation values. The formula for calculation of recaptured deprecation is Recaptured depreciation Selling price of the asset Deprecated value of the asset where the depreciated value of.

Basis divided by 139ththe amount you can. This is how much you can. 37 tax rate x 500 One year and one day later you sell this for 500 the same price.

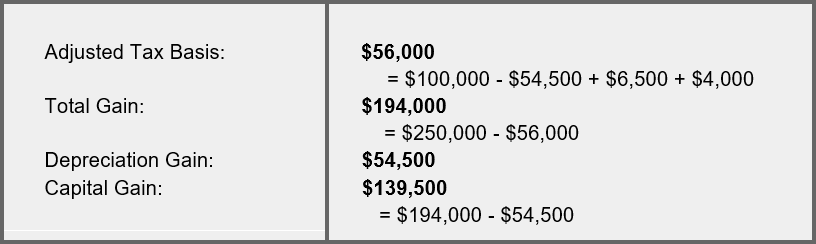

Depreciation recapture Realized gain. The total amount of tax that the taxpayer will owe on the sale of this rental property is 015 x 155000 025 x 110000 23250 27500 50750. Youd owe 6750 in tax if the IRS taxed this at the 25 depreciation recapture rate and you might owe capital gains tax as well.

He subtracts 10000 the lesser of the proceeds of disposition of the property minus the related outlays and expenses. Since this investor claimed a total of 300000 in depreciation over the years 300000 of their realized gain gets taxed at the depreciation recapture rate which is capped. The DB function performs the following calculations.

Depreciation allowed or allowable 179 bonus Unused 179 bonus or 71200 - 100000 30000 a positive 1200. 6 Multiply your capital gain by the capital gains tax rate and your depreciation recapture gain by your ordinary income tax rate to determine your total tax liability. Fixed rate 1 - salvage cost 1 life 1 - 100010000 110 1 -.

Youd then subtract 12000 from that value to earn a realized gain of. If the realized gain accumulated depreciation. Tax Realized gain Depreciation recapture tax.

You can generally figure depreciation on the business use portion of your home up to the gross income limitation over a 39-year recovery period and using the mid-month. This value would be your net proceeds. Lets discuss each one of them.

135000 x 002576 34776. Gain sale price basis. The calculation goes as follows.

This gives you a reduction of ordinary income in the amount of 500 and tax savings equal to 185.

Learn About Depreciation Recapture Spartan Invest

Chapter 17 After Tax Economic Analysis

Depreciation Starting With The Basics Ilsoyadvisor

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

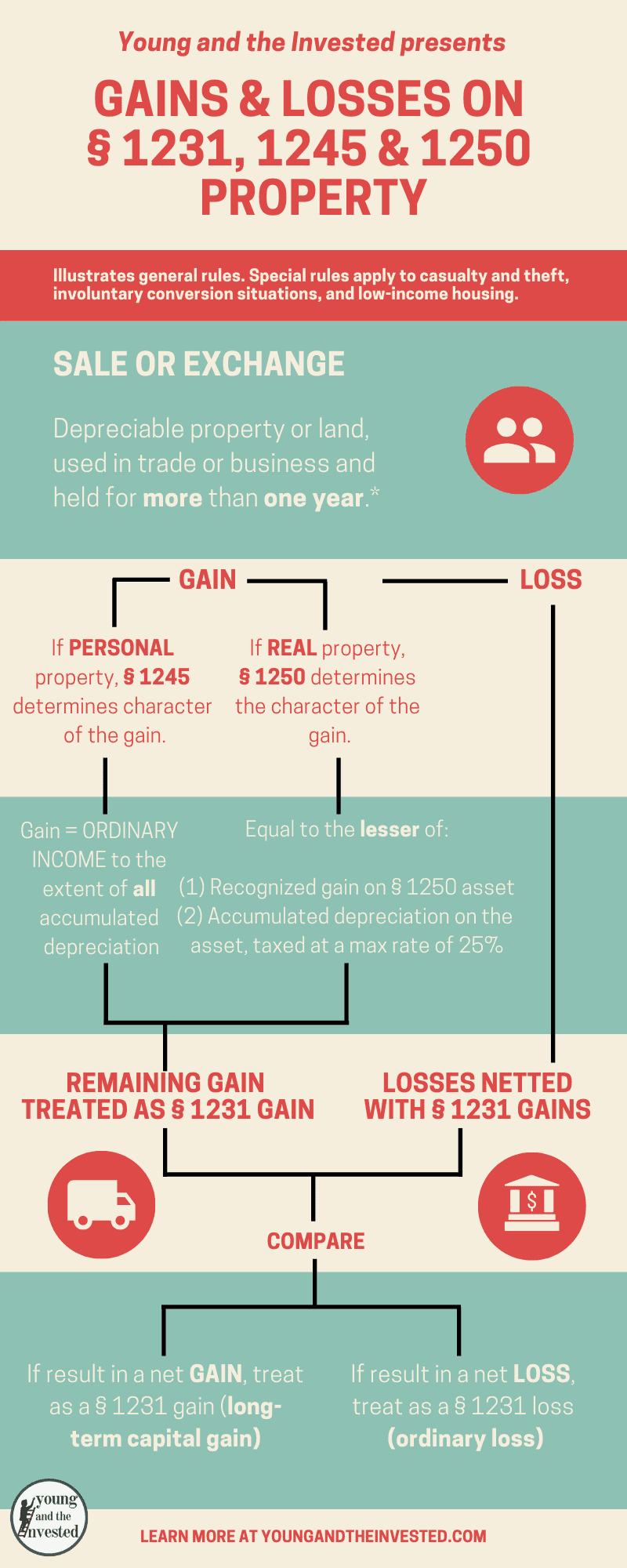

Capital Gains And Losses Sections 1231 1245 And 1250

Like Kind Exchanges Of Real Property Journal Of Accountancy

Learn About Depreciation Recapture Spartan Invest

Learn About Depreciation Recapture Spartan Invest

Chapter 8 Depreciation And Income Taxes Ppt Video Online Download

Do I Have To Pay Tax When I Sell My House Greenbush Financial Group

Contributed Property In The Hands Of A Partnership

How To Use Rental Property Depreciation To Your Advantage

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Chapter 8 Depreciation And Income Taxes N Asset

Chapter 8 Depreciation And Income Taxes N Asset

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Capital Gains And Losses Sections 1231 1245 And 1250